❯ Strategy Lessons from Games: Wingspan

Category: Business

Series: Strategy Lessons

Everyone wants to be a strategist. It's glamorous work, viewed as a proxy for intelligence. True or not, most job functions place an increasing importance on strategic skills to progress. Yet, opportunities for strategic work are naturally limited; it is inherently constrained by position and organizational design. What gives here? How do we practice the craft with limited opportunities?

Cue Games. Hades to Wingspan, Civilization to Soccer, they are the perfect playground for leveling up strategy skills. Competition, resource management, disparate and distinct choices, changing environments, and execution... all present in games with strong parallels to real strategy work.

So, what lessons in strategy can we learn from games and apply to work?

WINGSPAN SWOOPS IN FOR THE FINALE

Who knew a game about birds would set record sales? I didn't believe the hype, either—until I gave it a shot. You play as a bird enthusiast (stay with me) building out your wildlife preserve. It's an engine builder, so each new bird works together to create potent combinations. The goal is to balance food, egg, and bird production while gaining points from birds, bonus cards, and end-of-round goals. The player with the most points at the end of four rounds is Avian Extraordinaire.

Perhaps this is written solely to immortalize my win against (much more experienced) friends. Regardless, we end this series on strategy with drawing insights and parallels from a game about birds to real world strategy work.

A BLUEPRINT FOR A WINNING HAND (& FIRM)

I chose card draw as my engine. It's a sweaty proposition. Drawing more cards is a boon by simply giving you more options to consider. The game ends after four rounds, though, and that's a razor thin margin for effectiveness. The more cards drawn, the better probability a card shows up that matches your long-term game plan. Imagine if you drew ten cards in Poker while the rest of the players were stuck with five. That's the power of card draw.

More information, better chances.

There are similar blueprints for creating a successful firm—firms that are more valuable than typical and sell at above-average multiples. I found one such blueprint from Scott Galloway. The gist is this: firms that sell for higher multiples than average had four things in common: recurring revenue, defensible IP, niche focus, and a global footprint. He opted into this blueprint with his firm L2. L2 opened their doors in 2010 and sold to Gartner seven years later for $155 million.

One hundred and fifty five million.

It's quite the compelling story. Blueprints can be a valuable and simple starting point for strategy.

EXPLORE & CAPITALIZE: n-SHAPED OUTCOMES

Card draw turned into something else: food and eggs.

Since I could draw more cards than other players, I had a better pick of birds that complimented my hand and habitat. I used the results to buy resources I couldn't buy otherwise: two food instead of one, additional eggs for platform-nesting birds, that kind of thing. One activity enabled another. What began as a rough strategic idea became an optimized engine.

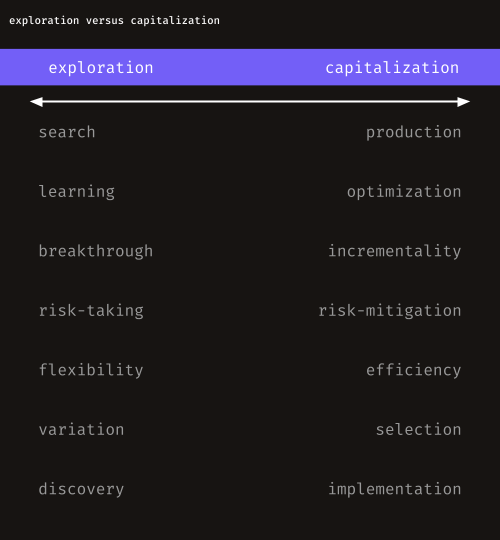

Leaders have the same continuum to contend with: Exploration versus Capitalization.

Choosing Exploration activities crowds out Capitalization activity (and vice versa). That choice, Exploration or Capitalization, has an outcome: incremental innovation happens by Capitalization-led exploration while radical

innovation occurs solely by Exploration.

Where things get interesting is return on investment. There's an n-shaped (or 'inverted u', as the researchers call it) relationship in capitalizing on a new capability or investing in innovation: they start with low payout and increase with additional investment until they hit a specific threshold, then have diminishing returns.

A few years back, this lesson played out in CPG. At the time, P&G was investing 3% of total revenue (roughly $2B) year over year. For reference, $2B would buy you twenty-six Caribbean islands. And yet, their R&D efforts had no impact on sales growth. On the other hand, Reckitt Benckiser's R&D efforts, which had a lower percentile investment (1.5%) and absolute dollar amount, led to measurable sales growth.

STRATEGY IS A GAME OF (ORCHESTRATING) RESOURCES

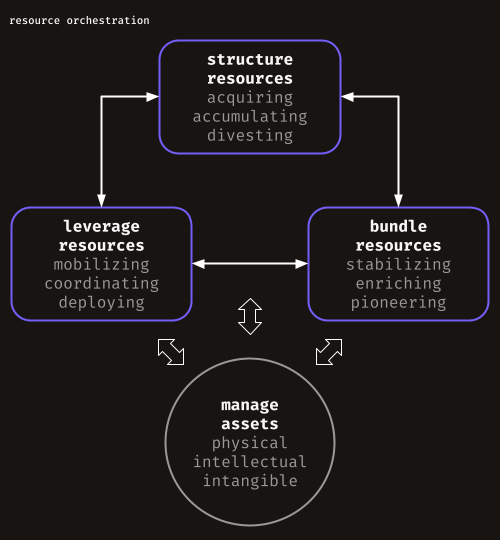

At the end of the day, Strategy is a game of resources. Wingspan players have limited time to secure birds, eggs, or food and win. Hades, Civilization, not-for-profit, for-profit… the same idea holds true: the team or firm that can better acquire and use their resources will win.

As it turns out, this concept has legs in the strategy field. Resource Orchestration Theory was born from the Resource-Based View and cousins with Dynamic

Capabilities Theory. Resource Orchestration (RO) says competitive advantage happens through managing assets effectively plus the structuring, bundling, and leveraging of resources.

RO needs more meat on the bone. Two limitations come to mind: (1) there is a distinct lack of customer and marketplace considerations and (2) it is more of a theoretical approach than practitioner applicable. Add external analysis and combine it with an operating model (say Wharton's business model design), and you'll have a strong framework for strategic decision-making.

Snapshot:

"Dad, I want to play with you still!" I froze. I could hear the tears before I saw them. I turned back around to see a distraught toddler, frantic that I was leaving our kitchen table. We had to get out the door... but who knows if I'll ever get another moment like this? I sat back down to continue playing Popsicle Truck.

Striving for better,

Justin Pichichero